EXCLUSIVE OPPORTUNITY

As seen in:

EXCLUSIVE OPPORTUNITY

As seen in:

Why Smart Investors are Turning to the Heartland's Multi-Family Real Estate Market

Dear Investor:

We have some big news to share, especially if you are interested in PASSIVE real estate investing.

Iowa based Heartland Multi-Family Companies plans to allow the Public to invest and own their very own multi-family properties in the great state of Iowa.

And we have more good news: We are offering Shares In our Company — so investors like you can own their very own Iowa based multi-family apartment community.

If you qualify, you can invest in our company!

For as little as $100,000 you can become a shareholder and owner of Heartland Investment Partners – and be part of owning over $80,000,000+ in terrific multi-family real estate with a 93% occupancy rate and a proven track record across six funds.

You can own America’s best in multi-family real estate.

You can sign up now to get NO OBLIGATION information about our planned public investment opportunities.

You will want to look into being a be part of our family of investors here with Heartland Multi-Family because we’ve been achieving terrific results:

Heartland Multi-Family has become the “go to” passive multi-family investment for many investors, and these properties are some of the most sought after properties to own in the United States.

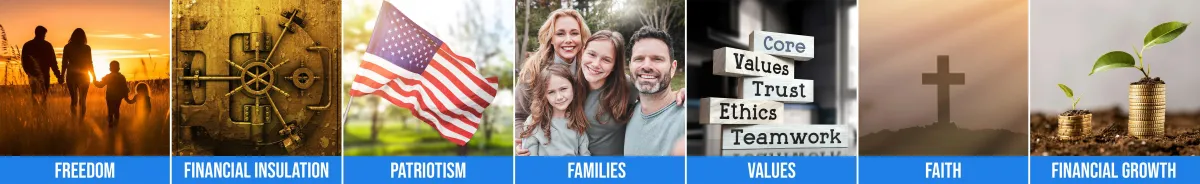

We have developed a tremendous multi-family investment base, that includes over 1,300 apartment units in the state of Iowa and over 30 years of operational and management experience excellence.

Iowa is one of the top places in the United States to live and raise a family as one of the most conservative markets to own real estate.

We have demonstrated remarkable growth with well over 10 years of continuous track record in multi-family investment, management and operations: We will be using our solid investment base as well as our track record of success along with $80K-$120K unit costs to scale over 10,000 units in the next ten years.

While achieving this success, Heartland Investment Partners has stayed true to our mission of changing investors financial lives by showing them how to own FULLY VETTED Heartland of America multi-family properties. Providing investors honest real estate investing and ownership alternatives.

Last year SAFEHOME.ORG found that Iowa was one of the top 10 places to raise a family in the entire US! Heartland Investment Partners was one of the most trusted multi-family real estate investment companies in the U.S.

Now more than ever — especially as more and more Americans are needing and wanting affordable and flexible housing alternatives — America needs Heartland Multi-Family.

Take a moment to view our presentation and read our Private Placement Memorandum.

Join with us in investing profitably and keeping your investment choices strong and free.

Sincerely yours,

Please note: the Shares are for investment only by investors who meet the qualifications of an Accredited Investor, as defined in Regulation D promulgated under the Securities Act of 1933. *See More on Accredited Investors

Join Our Real Estate Revolution

Our Mission

Heartland Investment Partners

Changing investor's financial lives by showing them how to own fully vetted Heartland of America multi-family properties.

We Believe

The Vision

Heartland Multi-family is restoring trust

Heartland Multi-family is providing Americans with real investing, honest, property investment alternatives and clear analysis.

Heartland Multi-family gives investors the ability to own their own fully vetted Iowa based apartment communities.

Heartland Multi-family is the place many investors call home. A family of like minded investors for decades.

Step into the Future of Real Estate: Own a Share in heartland of america's Multi-Family Success

Not accredited? No problem. Register now to get details on investment opportunities that will soon be open to you.

The Place for Investing

Unit cOunts soared

Made in the u.s.a investing

REGISTER NOW AND GET THE OFFERING DOCUMENTS!

Legal Disclaimer: Heartland Investment Partners is currently undertaking a private placement offering pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Rule 506(c) of Regulation D promulgated thereunder. Investors should consider the investment objectives, risks, and investment time horizon of the Company carefully before investing. The offering documents relating to this offering of equity interests by the Company will contain this and other information concerning the Company and the securities referenced in this document, including risk factors, which should be read carefully before investing. Securities of the Company are being offered and sold in reliance on exemptions from registration under the Securities Act. In accordance therewith, you should be aware that (i) the securities may be sold only to “accredited investors,” as defined in Rule 501 of Regulation D; (ii) the securities will only be offered in reliance on an exemption from the registration requirements of the Securities Act and will not be required to comply with specific disclosure requirements that apply to registration under the Securities Act; (iii) the United States Securities and Exchange Commission (the “SEC”) will not pass upon the merits of or give its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials; (iv) the securities will be subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities; investing in these securities involves a high degree of risk, and investors should be able to bear the loss of their entire investment. Furthermore, investors must understand that such investment could be illiquid for an indefinite period of time. The offering documents may include “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions for forward-looking statements. This information is supplied from sources we believe to be reliable but we cannot guarantee accuracy. Although we believe our expectations expressed in such forward-looking statements are reasonable, we cannot assure you that they will be realized. Investors are cautioned that such forward-looking statements involve risks and uncertainties, including, but not limited to the risks and uncertainties set forth in the attached materials, which could cause actual results to differ materially from the anticipated results set forth in such forward-looking statements. Any forward-looking statement made by us speaks only as of the date on which it is made, and we undertake no obligation to publicly update any forward-looking statement except as may be required by law. Any person’s indication of interest involves no obligation or commitment of any kind. The information in that offering statement will be more complete than the information the Company is providing now, and could differ materially. You must read the documents filed. No offer to sell the securities or solicitation of an offer to buy the securities is being made in any state where such offer or sale is not permitted under the “blue sky” or securities laws thereof. No offering is being made to individual investors in any state unless and until the offering has been registered in that state or an exemption from registration exists therein. The securities offered are highly speculative and involve significant risks. The investment is suitable only for persons who can afford to lose their entire investment. Furthermore, investors must understand that such investment could be illiquid for an indefinite period of time. No public market currently exists for the securities, and if a public market develops following the offering, it may not continue.

2025 Darin Garman. All Rights reserved